Effective inventory management is crucial for business profitability. Beyond the obvious expenses, several hidden costs can significantly impact the bottom line.

This article will explain the 9 key parameters that influence inventory costs, offering insights and strategies to manage them effectively.

Check our inventory costs calculation tutorial below (covering 12 parameters)

How much does your inventory really cost you? Let me tell you about the 9 parameters which can influence the cost of inventory :

- Cost of carrying inventory

- Insurance costs

- Storage costs

- Costs to check inventory

- Costs relating to quality gaps with inventory

- Promotion costs

- Destruction/donation costs

- Complexity cost

- Non-investment costs

1. Cost of carrying inventory

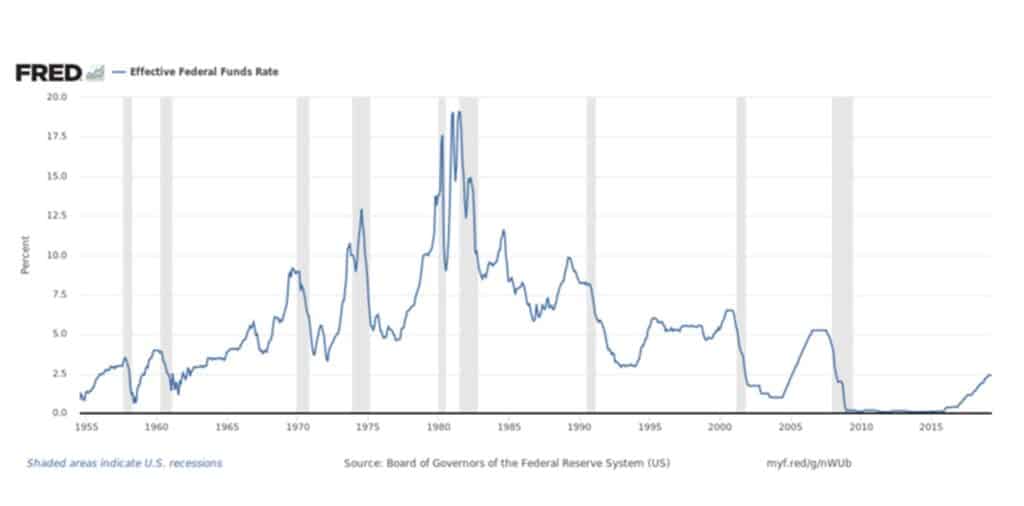

How much does your credit cost you, exactly? In the past few years, money has become quite cheap: with extremely low interest rates, it is fairly easy to borrow funds.

We can see it with the case of the United States in the graph below. After a fall of the rates due to the 2008 crisis, they stand today at around 2.5% – to which the bank usually adds its processing fees when you contract a loan.

But be careful with mistakes when you calculate your cash flow: you should not measure your interest rates based only on your inventory’s value, you also have to include the payment periods.

Between your payment to the suppliers and the one you get from your client, you have a cash flow gap that you have to include in your calculations.

Example: I have to pay my supplier after 30 days, I get the payment from my client after 60 days. I have a cash flow gap of 30 days.

You need to add this gap to your stock rotation to calculate it in its entirety. So if your stock rotation is 70 days, for example, your total inventory to fund will be significantly higher, 100 days.

Some businesses still manage to obtain a positive cash flow, I’ll tell you about it in a future article.

2. Insurance costs

Many companies will choose to insure their inventory, and the rates vary. It can go from some tenth of a percent to several percentage points depending on the risks of the product.

If you choose to insure your inventory, you have to add these costs.

3. Storage costs

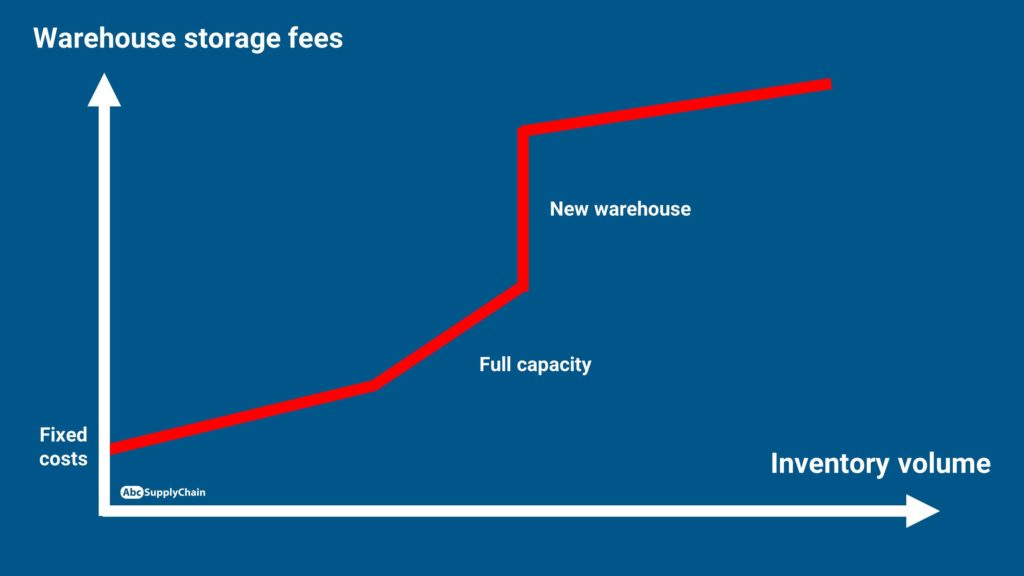

You should obviously take into account the price of your storage space. Just like the oil example mentioned earlier, the curve of your costs won’t be linear.

Your fixed costs (rent, utilities, electricity, handling staff…) first increase proportionally; but once you reach 85 or 90% of your occupancy rate, you are at full capacity. Then you have no choice: you have to start stocking the surplus of merchandise in a new space. And this can generate overhang fees – generally higher – as well as transport costs. Suddenly, your costs explode and the curve climbs instantly.

4. Costs to check inventory

It is the price you pay to have the quality of your inventory checked. Because if you have inventory problems, you’ll have supply problems and eventually get out of stock.

It represents generally a price per unit, or a percentage of your total inventory volume every year.

5. Costs relating to quality gaps with inventory

The inventory can show unpleasant surprises: missing products, quality issues, computer or synchronization problems…

The gaps can be only a few tenths of a percent or outright several percentage points of your stock. The missing elements will have to be replaced, which adds more fees.

6. Promotion costs

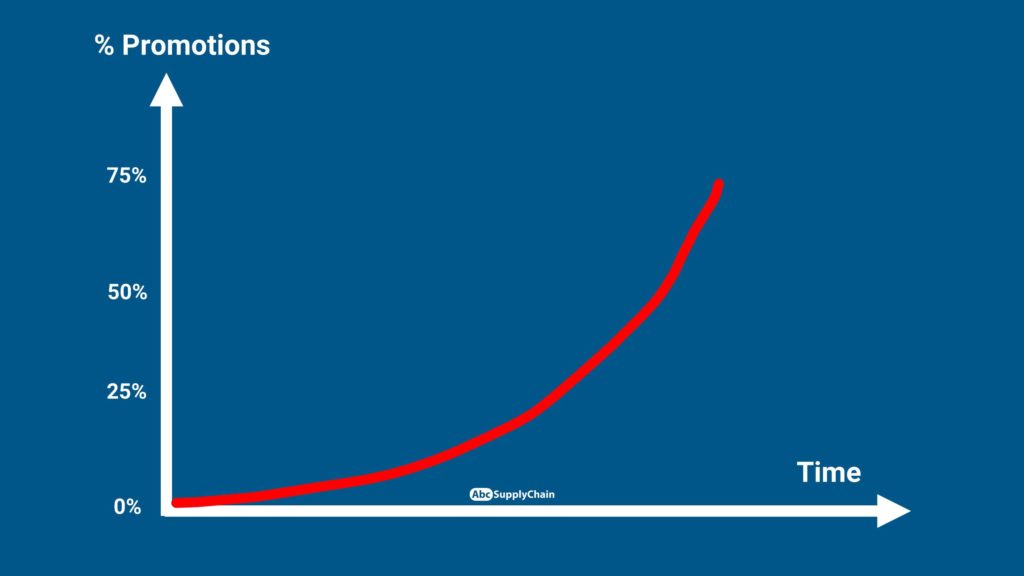

It is a difficult number to incorporate into the calculation, but it is underestimated. It is notably visible in the textile industry, which is punctuated by summer and winter sales.

Your winter collection product, which initially costs €50, sees its value affected when summer sales come. You will have to consider a discount. And the drop in prices won’t be linear, it radically speeds up with the arrival of good weather.

The average rates vary from industry to industry, but you have to count the impact of promotions on the profitability of your product when you are evaluating your stock.

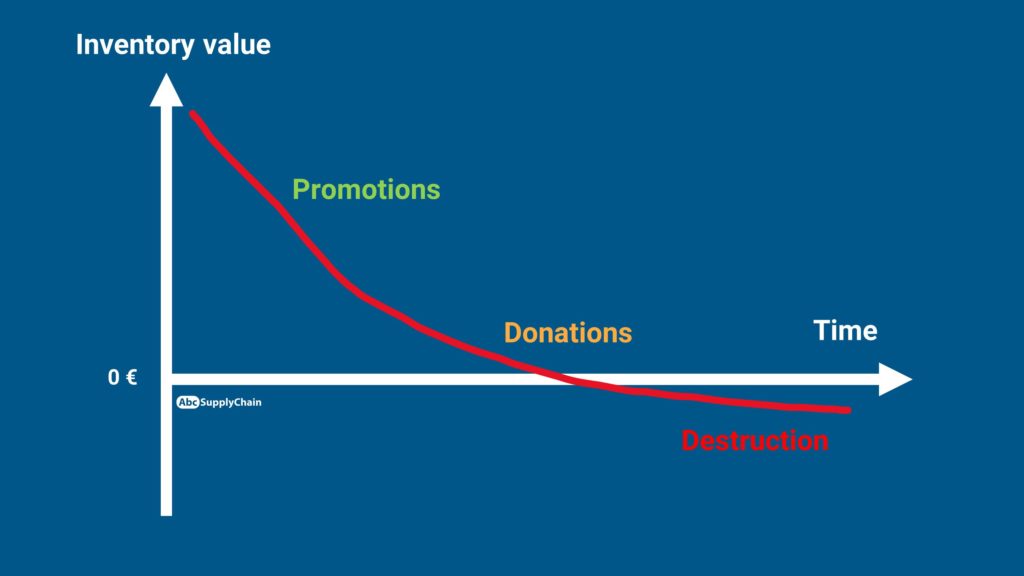

7. Destruction/donation costs

Consumables, fresh goods, or fashion products lose value quite fast if not sold.

You have several options: once the promotion time has passed, you can gift the product (coupled with another one, for example, we see it a lot in mass retail). From a purely financial point of view, it is more interesting to give the product away than to destroy it or recycle it, which will bring new costs.

Think about the percentage of products you give away or destroy when calculating the total price.

8. Complexity cost

The number of warehouses you use plays a great role in the smoothness of your supply chain. The more inventory you have, the more complicated it is to handle, as you can see in this graph.

Complexity costs are hard to quantify, but having less inventory will allow you to simplify your process and eliminate management errors considerably – and it will help you think about all this more calmly.

To illustrate it, I take the example of the fridge: if it is too full, you will struggle to see what is hidden at the back. You risk having to throw away a lot of food. If you keep it at the bare minimum, all of your elements are accessible and you are not as likely to waste.

9. Opportunity cost

It is probably the most subtle of your costs. The funds blocked in your inventory will not be invested in the development of your business, whether it is to buy a new product or launch on a new market. It takes away the opportunity of other potentially more profitable investments.

You would have to discuss it with your financial director, but it is also an expense to factor in if you want to have a truly global vision of the cost of your inventory.

So, how much does your inventory cost exactly?

Companies usually evaluate their costs at around 5 or 6%, but taking into consideration all of the parameters we just listed, in reality, it is more often than not over 10%. Of course, it depends on your industry, and notably the costs of promotions and destruction.

Example: You add €1M worth of inventory to your company; the cost of this inventory will be 20%, so €200.000 of fees will be generated.

There is Supply Chain a real issue in understanding the impact of the stock.

It is obviously necessary at the start to improve your service rate. But your service rate curve will stagnate quickly, and that is when your returns drop, as you can see in the graph below.

Your goal in Supply Chain will be to find your balance point in your profitability. It is extremely hard to find: you have to know precisely your level of inventory and your acceptable service rate.

To learn more about this matter, please read my article about the Wilson formula.

I insist on the importance of calculating your inventory cost because it is for me a fundamental and wildly underestimated parameter. Businesses usually only focus on their service rate or availability ratio, which impacts their rentability.

As a Supply Chain Manager or Director, to better manage your inventory, your challenge is to find the famous balance point between inventory cost and service rate. My advice is to adapt your goals to the different types of products and use the ABC Analysis (which I explain HERE) to concentrate your efforts on your most important references.

Don’t hesitate to share these numbers within your company, for example with the communication/marketing departments, who often don’t realize the impact of inventory surplus on a business, its future investments, and growth potential.

Main things to remember

What are the key parameters influencing inventory costs?

Inventory costs are influenced by several factors, including:

- Complexity Cost: Additional costs stemming from managing a diverse product range or complex inventory systems

- Cost of Carrying Inventory: This encompasses the expenses related to financing the inventory, such as interest rates and the cash flow gap between supplier payments and customer receipts.

- Insurance Costs: Premiums paid to insure inventory against risks like theft, damage, or obsolescence.

- Storage Costs: Expenses associated with warehousing, including rent, utilities, and labor.

- Costs to Check Inventory: Costs related to quality control and verification of inventory accuracy.

- Costs Relating to Quality Gaps with Inventory: Expenses arising from defects or non-conformance to quality standards.

- Promotion Costs: Discounts or marketing expenses to move excess or slow-moving inventory.

- Destruction/Donation Costs: Costs incurred to dispose of or donate obsolete or unsellable inventory.

- Opportunity Cost: The potential revenue lost by tying up capital in inventory instead of other investments.

How does the cost of carrying inventory impact overall expenses?

The cost of carrying inventory includes financing charges, such as interest rates on borrowed funds, and the cash flow implications of the time lag between paying suppliers and receiving payments from customers. Miscalculating these can lead to underestimating the total inventory investment.

Why is it important to consider insurance and storage costs in inventory management?

Insurance costs protect against potential losses from unforeseen events, while storage costs cover the physical space and utilities required to house inventory. Both are essential for accurately assessing the total cost of maintaining inventory.

What are the implications of not accounting for quality-related inventory costs?

Neglecting quality-related costs can result in increased expenses due to defects, returns, and customer dissatisfaction. Regular quality checks and addressing quality gaps are vital to minimize these costs and maintain customer trust.

How can understanding opportunity costs benefit inventory management?

Recognizing opportunity costs helps businesses evaluate the trade-offs between investing in inventory and other potential investments. By understanding these costs, companies can make informed decisions to optimize resource allocation and profitability.

To go further

If you want to go deeper into the topic, please take a look at my articles about :