How to Make Accurate Sales Forecasting for New Products?

This is not an easy task, and a mistake can be costly for the company, whether due to stock shortages or overstock. In this article, we outline 19 essential steps to enhance the accuracy of your forecasts, whether for permanent products or seasonal collections. Additionally, we highlight common pitfalls to avoid, ensuring more reliable and data-driven decision-making.

Forecasting Sales for New Products: Step-by-Step Guide

Is it really possible to forecast new products?

It is essential to understand that there are different types of new products:

- Variations

- Innovations

Minor variations involve small adjustments, while innovative products—such as Elon Musk’s flying scooters, the Cybertruck, or Apple’s Vision Pro—have no direct comparisons.

It is also important to consider the concept of the product life cycle: a T-shirt that remains in a product line for three years is not comparable to a fast fashion collection that lasts only three months.

Managing an innovative product with a short lifecycle is far more complex than handling a long-cycle product where adjustments can be made.

In this article, we will explore in detail how to forecast for these different scenarios using 19 steps from my comprehensive Forecasting Expert method. We will rely on concrete examples such as the Vision Pro or the Cybertruck.

Forecasting Similar Products – Permanent vs. Collection

Example with similar products

- A permanent product: a blue mountain bike and a new red model to be launched.

- A collector’s item: a t-shirt that was blue last summer and will be pink next summer.

The products are quite similar. So, how should we proceed?

Sales Forecasting for New Products: Complete Guide

The first step is to plan ahead. It may seem obvious, but starting schedules too late can create significant challenges.

It is important to identify every step:

- Design and Marketing

- S&OP Review (Sales and Operations Planning) to ensure all necessary conditions for the launch are met.

- Production Planning, including assessing raw material and component needs while evaluating the supply chain.

- Monitoring Supplier Production Timelines: Once committed, making changes before the launch date becomes difficult.

- Sales Phase: Some companies, like Zara, manage very short cycles, while for others, this process can take 10 to 12 months.

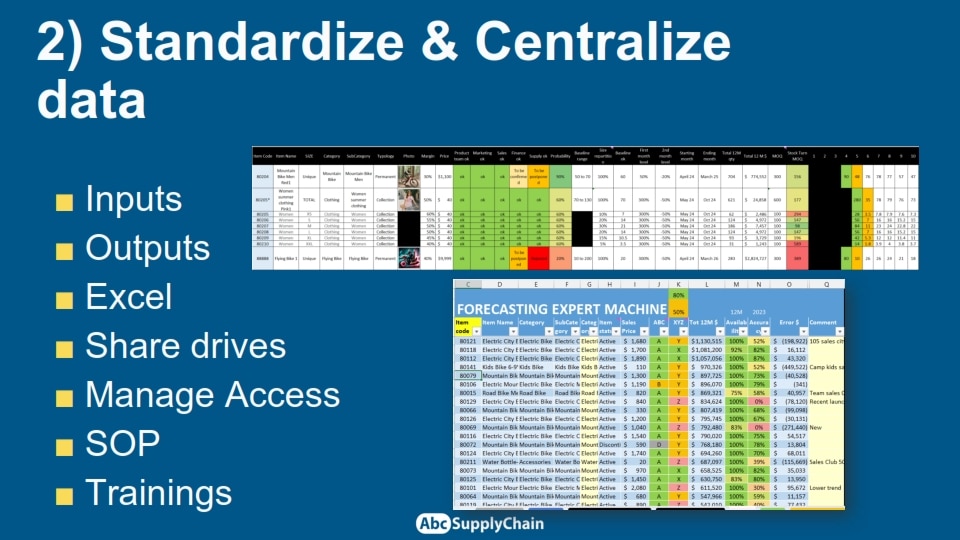

2. Standardize and centralize the data

The second step is to standardize and centralize data, which is a real challenge for many companies.

Data is often scattered across various departments—each using its own Excel files or software and with a different format, whether in product management, marketing, sales, or the supply chain. This creates real confusion and general disorganization.

It may seem obvious, but implementing it is not always easy.

Personally, when I was in charge of the Supply Chain or the S&OP process, the first thing I did was create a single, standardized file. This file became the reference, and everyone had to use it.

In short, everything must be perfectly structured and accessible. The file must be shared, access must be well-managed, and it is crucial to train everyone, including new hires, on how to use these new data standards.

If you don’t centralize and standardize information, you risk losing control during product launches, which can lead to major issues for the company.

3. Define responsabilities

It is essential to clearly define everyone’s responsibilities in launching this product.

Here’s an example of the responsibility chart we developed for our training courses, clearly defining the roles of the sales manager, production manager, product manager, logistics manager, and marketing manager.

It’s crucial to know who does what, and who’s responsible for which task. But who is responsible for forecasting a new product? The answer is simple: the person who knows the market and the product best.

This role isn’t necessarily limited to the sales manager—it could also be the product manager or market manager. What matters most is that the responsibility is clearly defined.

Moreover, one person may be responsible for certain types of information, such as who will buy the product, while another will be in charge of providing quantities or seasonality. It’s important to make these responsibilities clear, so that everyone knows exactly what they have to do, and can work efficiently.

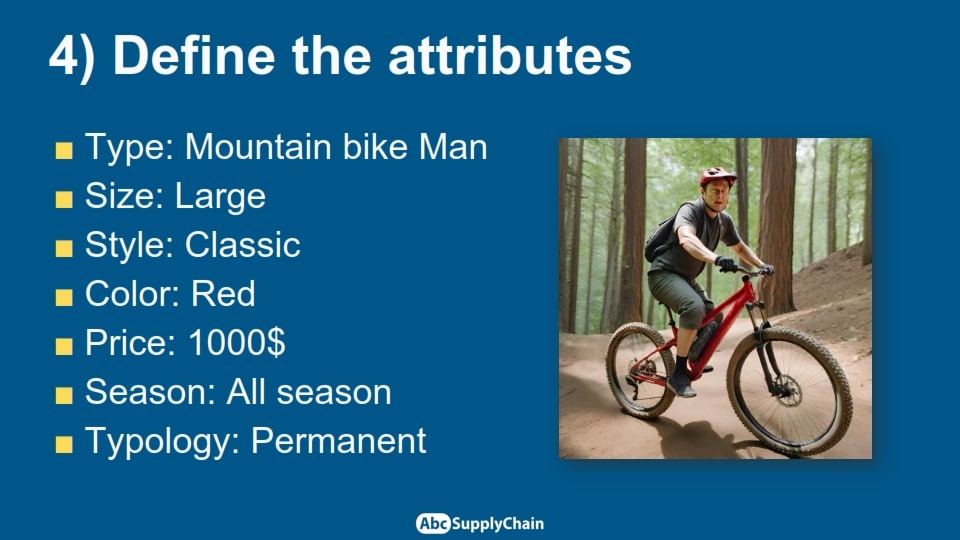

4.Define the attributes

The next step is to characterize the attributes that define the product. This will enable us to understand its specific features and compare it to other products. Here are the main attributes to define

- Type of product: What is the product?

- Size: For example, S, M, L, etc.

- Style: Classic, modern, trend, etc.

- Color: What is the color of the article?

- Price: What is the selling price?

- Season: Is it a summer or winter product?

- Typology: Is it part of a permanent or limited collection?

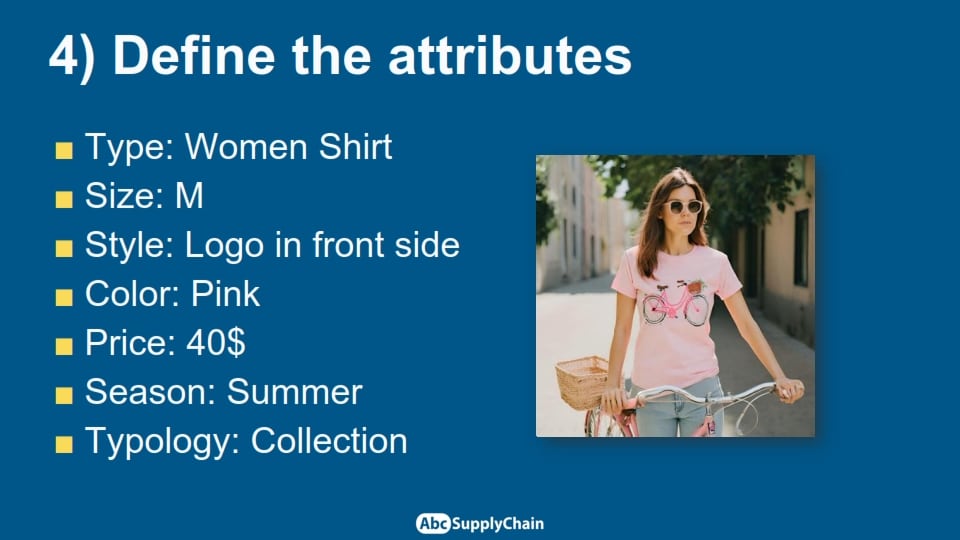

These attributes must be clearly defined to enable accurate comparisons with similar products. For example, if we take the case of a woman’s T-shirt, we might have the following information:

- Women T-shirt

- M Size

- Logo on the front

- Color: White

- Price: 25 €

- Collection: Summer

These are the elements that clearly define the product and situate it within a specific range or collection.

5- Find the most comparable products

Once you’ve defined the product attributes, you can compare them with other similar products. This comparison enables you to identify the closest references based on the defined characteristics.

For instance, if we have a blue bike, we can identify another model with nearly identical features, making it the most comparable product. Similarly, when analyzing a blue T-shirt, we can easily find a reference that closely matches in terms of cut, color, and collection.

This step is essential to refine the product analysis and better anticipate its market positioning.

6- Collecting market data

It is then essential to collect market data to identify what is efficient by cross-referencing internal company information with external sources:

- Benchmarking

- Analysis of the trends

- Influencer tracking

Working with marketing and product teams, attending conferences and using tools such as Google Trends gives us a more precise view of the market. With all the resources available online and in the media, it’s easier to anticipate trends and optimize product launches.

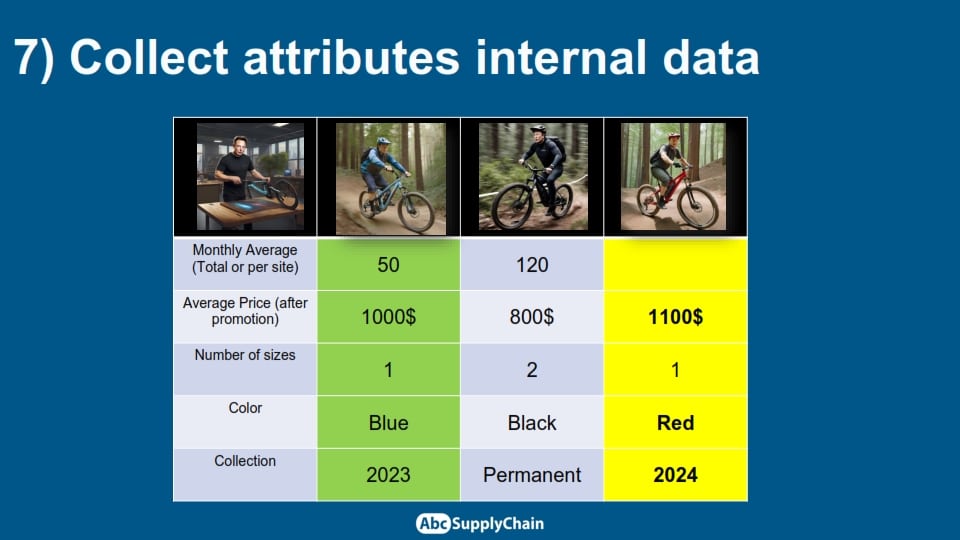

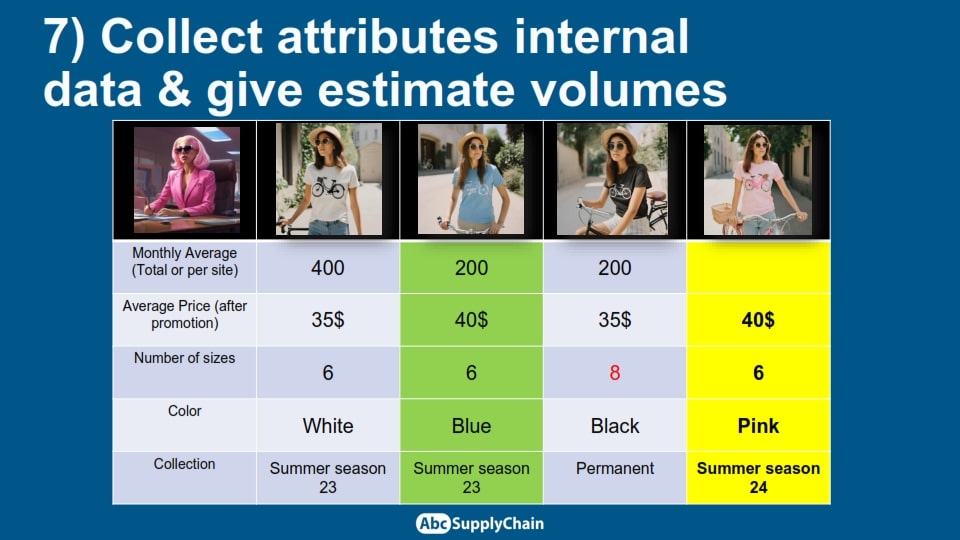

7. Collect the internal data and attributes

The next step is to analyze internal data in addition to market research information.

This involves listing sales attributes and trends, and comparing the new product with similar references.

- Analysis of the previous sales: Observe average sales of a comparable product, its price, and overall performance.

- Quantity of available sizes: A product with more or fewer sizes can impact sales.

- Key Characteristics: Color, collection, seasonality, market positioning.

- Comparison with a similar product: Find the closest item in terms of sales, by site, customer or store.

Whether we’re talking about the permanent bicycle or the collector’s T-shirt, the principle remains the same: the goal is to identify the product with attributes most similar to the new T-shirt you plan to launch and refine your launch strategy based on that.

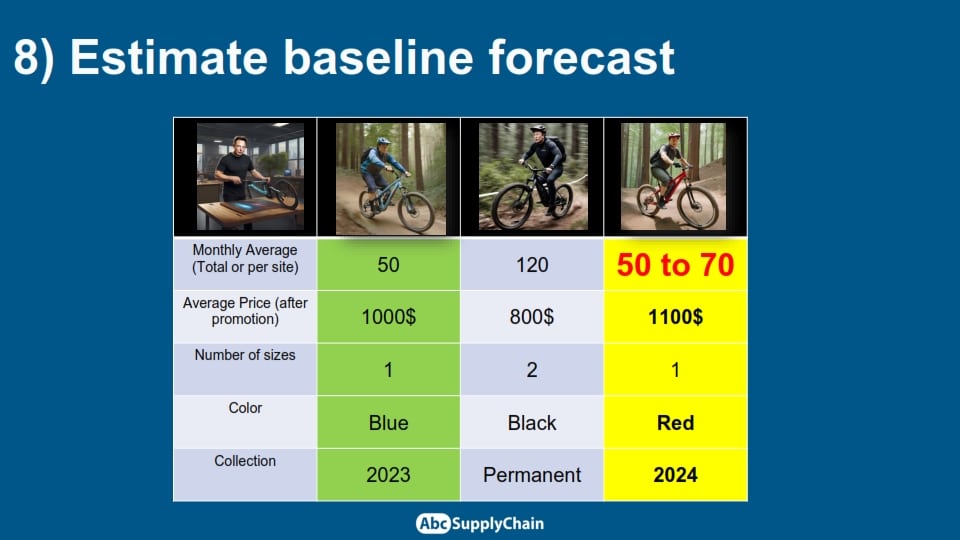

8- Estimate the baseline forecast

The next step is to estimate the baseline, i.e. the reference base for the sales rhythm.

For that purpose, we synthesize the two previous steps: analysis of market data and internal data.

For example, in the bicycle example, we’ve identified a similar product (the blue bicycle) to the new product we want to launch (the red one).

- The blue bike has an average sales of 50 units a month

- Our market research has revealed an upward trend in demand for products related to red bicycles.

We therefore decided to estimate the baseline for the future red bike as being close to the blue bike, but slightly higher, between 50 and 70 units.

Although this process is highly subjective, it is sufficient to start building a realistic, usable forecast.

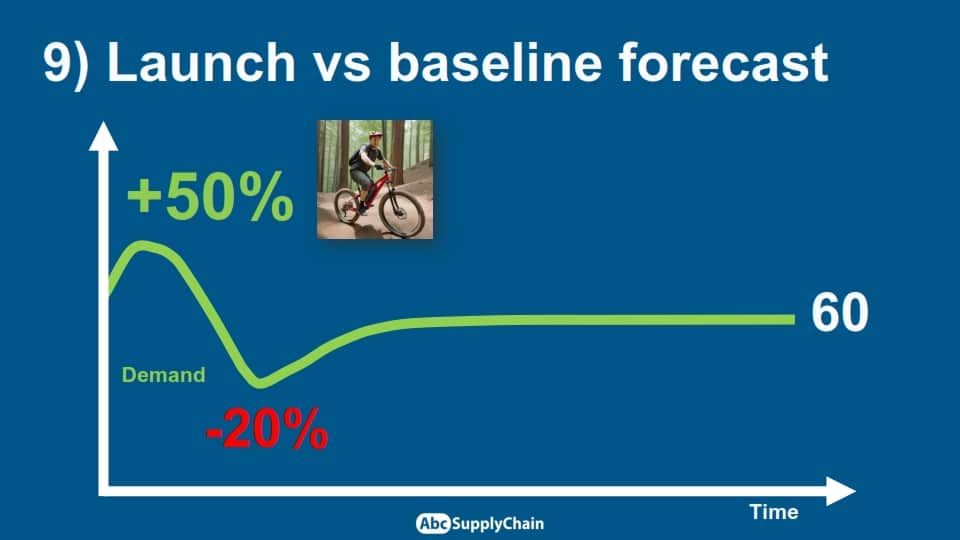

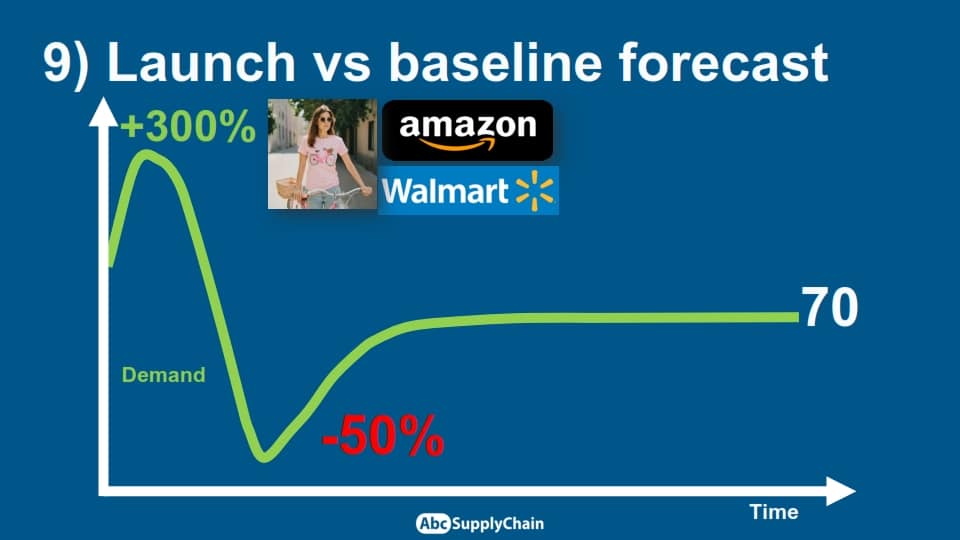

9 – Launch vs baseline forecast

The ninth step is to estimate the product launch, in addition to its sales baseline. When a product is launched, it generally experiences an initial peak, followed by a dip before stabilizing. This phenomenon can be attributed to the novelty effect: initially, consumers or distributors purchase in large quantities, followed by a decline in demand, which then stabilizes at a more consistent level.

To anticipate this dynamic, it’s essential to analyze historical data for similar products. We often observe a wave curve, with a sharp rise at launch, a gradual fall, and then stabilization. For example, a product may experience a +300% increase in sales, followed by a -50% drop, before having more regular sales.

Adjustment can be made :

- By studying internal data

- By exchanging with customers for a better understanding of the purchasing behavior.

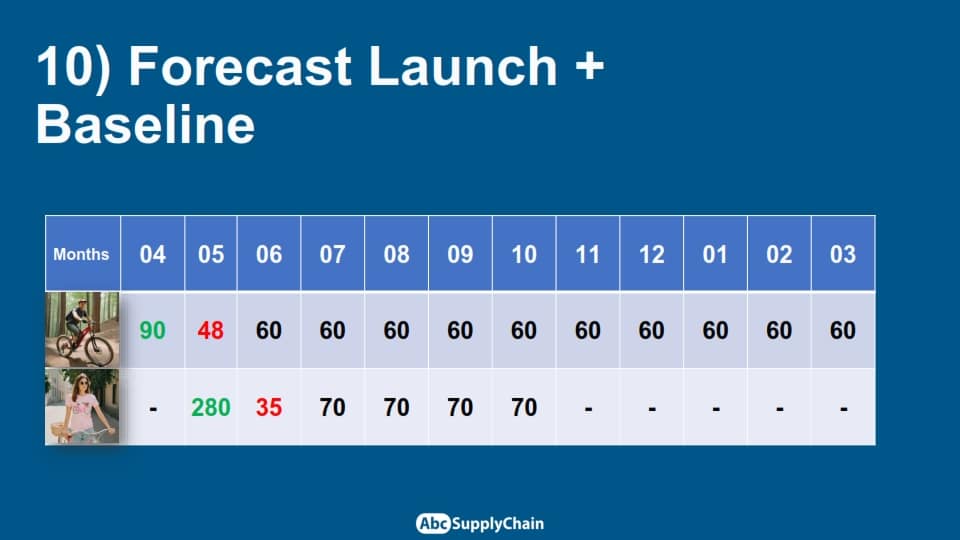

10 – Forecast launch and baseline

Once these elements have been defined, the forecast can be broken down into several phases.

In our 2 examples, we first consider the dynamics of the launch, with an initial increase of 50%, followed by a drop of 20%, before reaching a stable baseline of around 60 units for one product and 70 units for another.

This approach produces a more realistic forecast, taking into account the novelty effect, gradual sales adjustment, and long-term stabilization. The result is an accurate estimate that enables more effective production and distribution management.

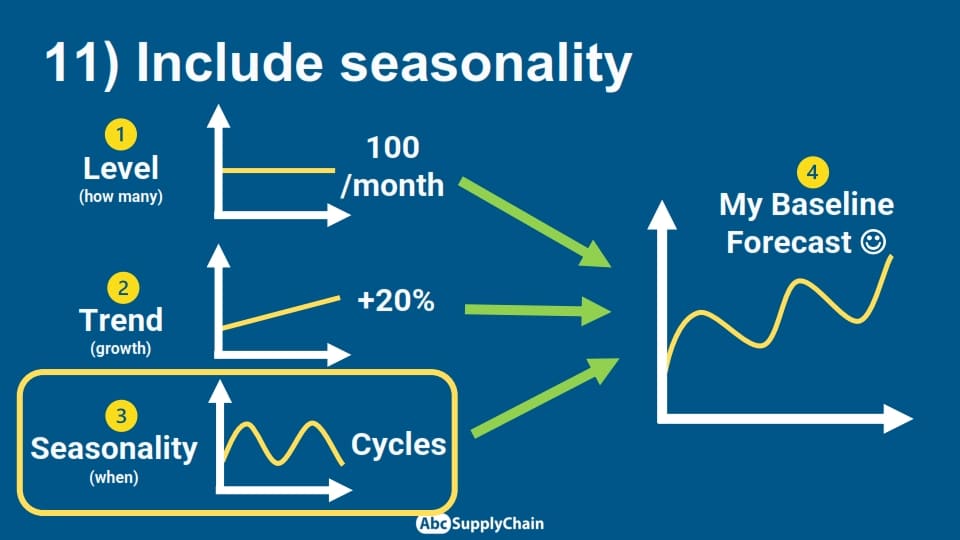

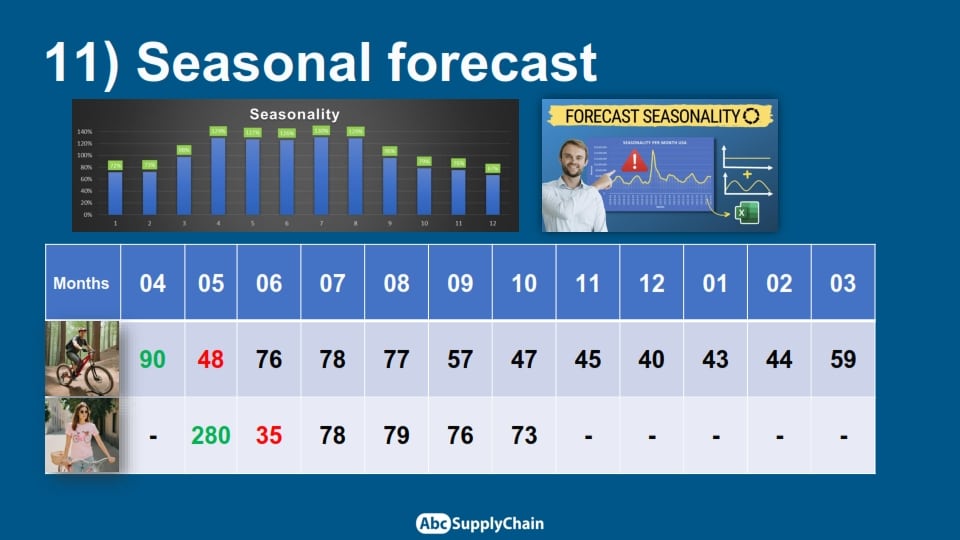

11 – Include seasonality

Once the baseline has been defined, it is essential to apply a seasonal effect to obtain a more accurate estimate of sales over time.

For example, ATVs sell more in the spring and summer than in the winter, which is expected. Similarly, a fashion collection may have a shorter lifespan, often concluding by October.

By incorporating these variations, forecasting becomes more accurate and aligned with natural market cycles, allowing a better production and inventory optimization.

12 – Check supply and MOQ impact

Once seasonality has been taken into account, it’s crucial to check the supply and the impact of the MOQ (Minimum Order Quantity), which corresponds to the minimum quantity imposed by the supplier.

This point is essential, as it can create an imbalance between forecasting and purchasing constraints. For example, if you plan to sell 100 units over one year but the supplier imposes an MOQ of 500 units, this will result in excessive stock equivalent to five years’ sales.

This calculation is essential to prevent excessive overstocking and high financial costs. Having an accurate forecast alone isn’t enough; it must also align with supply constraints. If the impact of the MOQ is too significant, it may be necessary to adjust the order, renegotiate terms, or explore alternative solutions to avoid potential losses for the company.

13 – Check the consistency of the forecast with each player

Once the forecast has been drawn up, it is essential to check and approve this data with all those involved in the product launch. This means ensuring that each department (marketing, production, logistics, etc.) validates the consistency of the forecast.

14 – Bring all the players together to validate a common vision

It is crucial that all stakeholders share a common vision and understand the projections and objectives. This stage enables final adjustments to be identified before action is taken, guaranteeing a successful launch.

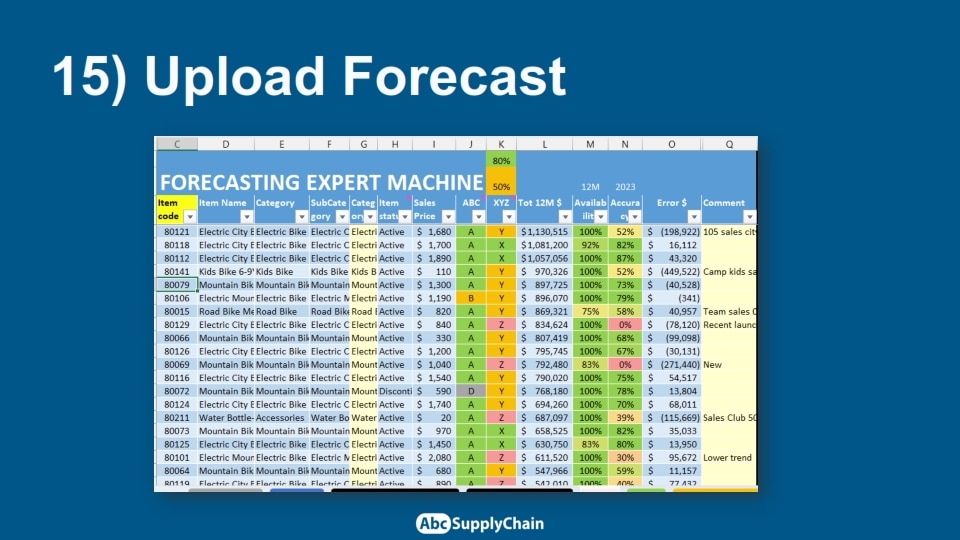

15 – Upload Forecast

Once the forecast has been validated, it’s important to download or upload it into your forecasting tool. This can be an Excel file, like the one I develop with my students, or a more sophisticated tool like ERP or specific forecasting software.

The key is to centralize all the data in one place, to facilitate monitoring and future adjustments. This ensures that all teams have access to consistent information, helping to prevent errors or inconsistencies throughout the various stages of the launch process.

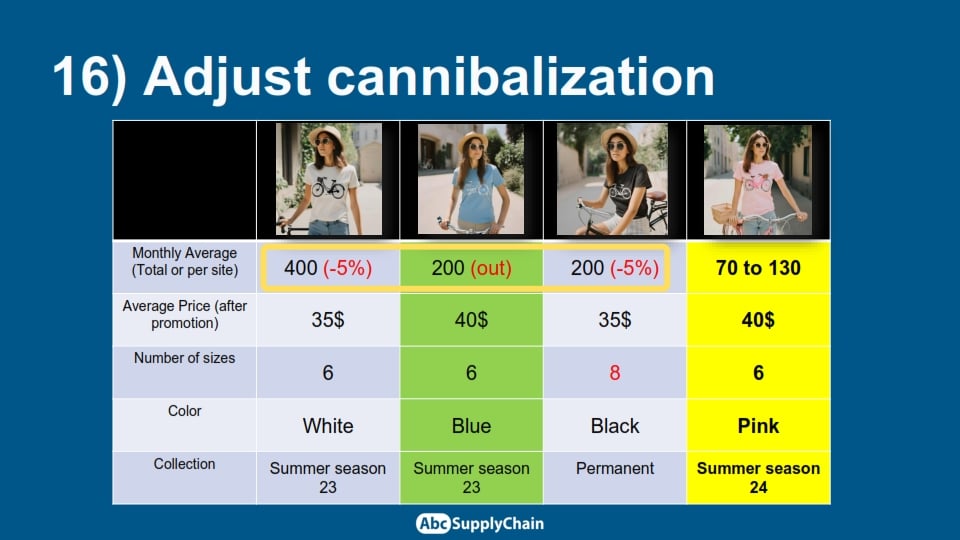

16 – Adjust cannibalization

It’s also crucial to consider adjusting for cannibalization, a topic that can be challenging to address. When a new product is launched, it can impact the sales of existing products, necessitating an adjustment to the forecast. This can be done based on experience and insights from similar products.

For example, if you introduce a new product to a range, it’s possible that sales of existing products will decrease, as some consumers will choose the new product over the existing ones. Adjustments linked to specific promotions or marketing campaigns may also impact sales of older products.

The key is to consider cannibalization from the outset. This will allow you to anticipate its impact and adjust your forecast accordingly.

17 – Review plan before launch

Next, it’s essential to review the plan before the launch. Often, an initial plan is created, but changes arise—deadlines, prices, or other conditions may shift. What seemed ideal at the start may no longer be feasible due to these adjustments.

Therefore, it’s crucial to hold regular S&OP (Sales and Operations Planning) meetings to ensure everyone stays aligned. It’s not just the launch date that needs to be reviewed, but also all other factors essential to the product’s success, such as:

- The costs

- Available resources

- Profitability targets.

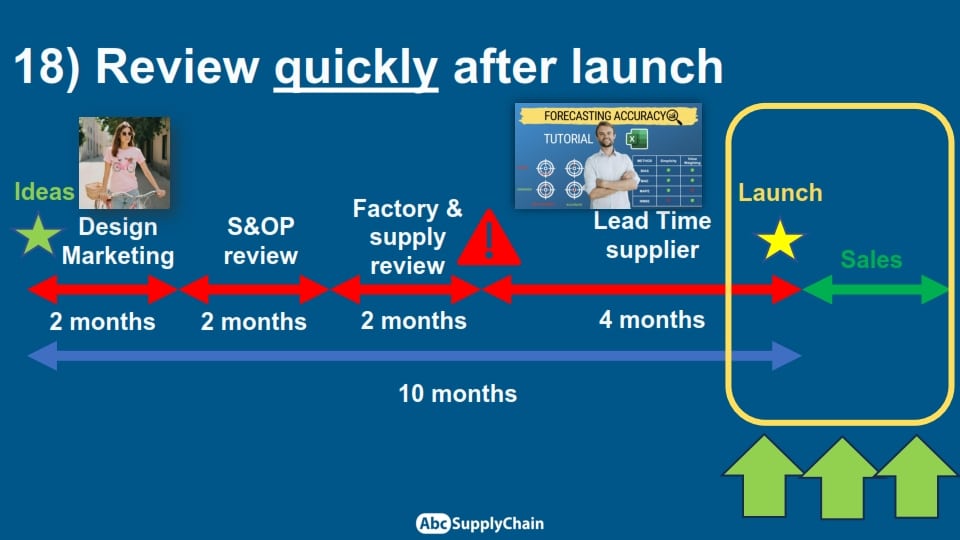

18 – Review quickly after launch

Finally, post-launch, it’s vital to regularly assess sales performance and revisit assumptions. A classic mistake I’ve made and often observed is neglecting follow-up once the product has been launched. We tend to concentrate on the new collection and forget to monitor sales of the current product. This can lead to major mistakes: either you realize that you’re selling far less than expected and continue to overorder, or you risk running out of stock too early without reacting in time.

Therefore, it is very important to measure the forecast accuracy quickly after launch so that orders can be adjusted accordingly.

I encourage you to check out my article on sales forecasting, where I offer a free Excel tool to evaluate the accuracy of your forecasts. This is especially important for new products, allowing you to respond quickly and refine your strategy if needed.

Check the Bullwhip Effect

It’s also essential to check for external effects, particularly those linked to distributors. For instance, when I sold products to supermarkets, they would initially purchase large quantities—a phenomenon known as the bullwhip effect. This occurs when they place a substantial first order but then halt further purchases due to excess stock piling up in their warehouses.

19. Collect data and repeat the process

After the product launch, it is essential to :

- Collect data

- Analyze performance

- Repeat the process and improve it for future launches.

Conclusion :

Ultimately, the key to a successful product launch is a clear, methodical structure with well-defined phases that are carefully executed. This approach minimizes errors, enhances decision-making, and fosters seamless collaboration between teams, leading to more effective launch management.

Forecasts for innovative products

Forecasting innovative products is a significant challenge since they have no direct equivalent in your catalog. Without historical data to rely on, it may seem impossible to make accurate predictions.

There are specific tools and methods for trying to anticipate demand for a product that has never been sold before, without having to make a random forecast or rely solely on judgment.

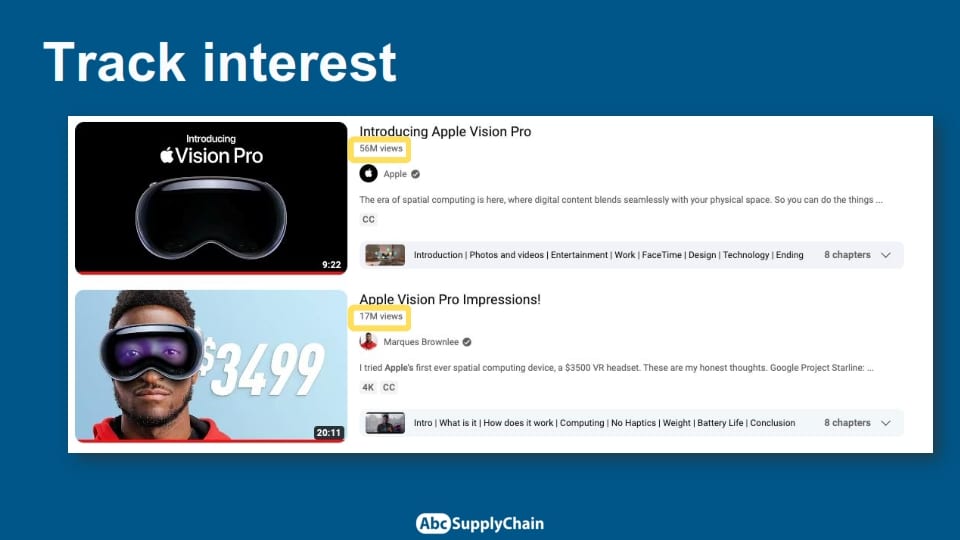

Track the interest

To anticipate demand for an innovative product, it’s useful to draw on proven strategies, such as Apple’s Vision Pro. With no direct market equivalent—especially at such a high price—how did they manage to forecast demand?

They have set up waiting lists to gauge consumer interest even before the official release.

You can do the same with your sales teams:

- Create a waiting list and observe how many customers sign up.

- Send introductory emails and track response rates for insights.

- Monitor views and engagement if you publish content about the product (for example, a video teaser).

Another approach is to test under real conditions:

- Launch pre-series in a few stores or regions to see the sales turnover.

- Offer pre-orders with a financial commitment, as Tesla did with the Cybertruck.

Finally, adapting your inventory management is essential. With a short lead time, an inaccurate forecast isn’t critical—you can quickly adjust and manage occasional shortages. However, with a long lead time, streamlining your process becomes crucial to minimize the risk of errors.

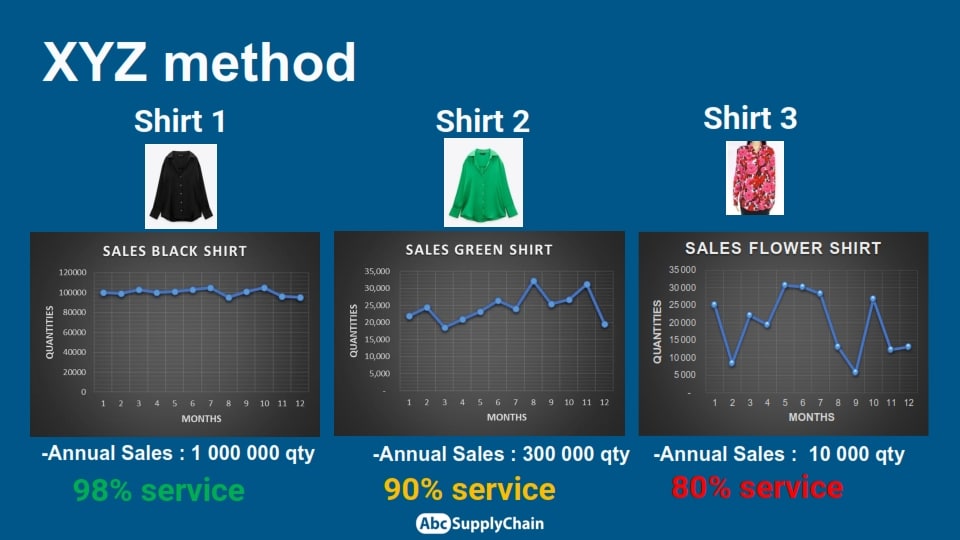

XYZ Method

It’s also essential to assess the level of uncertainty associated with your product. Some products are easy to predict because they are part of a stable and permanent demand, while others can be much more uncertain.

Expect different levels of service and inventory management for a highly innovative product than for a predictable one. Your approach should be tailored to the level of risk involved.

If you’d like to quantify this uncertainty, I invite you to discover the ABC/XYZ method, which enables you to assess the importance and predictability of a product in terms of profitability, inventory and cash flow.

Accept shortages

Running out of stock during a product launch isn’t necessarily a bad thing—in fact, it can be a positive sign. It means that customers want your product. A temporary shortage can even create an effect of exclusivity and desirability while avoiding overstocking.

Example: Each time a new iPhone is launched, Apple announces wait times that stretch for weeks, sometimes even months, yet the demand remains relentless.

If you find managing new product launches too complicated, it may be because you do them too frequently. The key is to optimize your processes and better prioritize your launches.

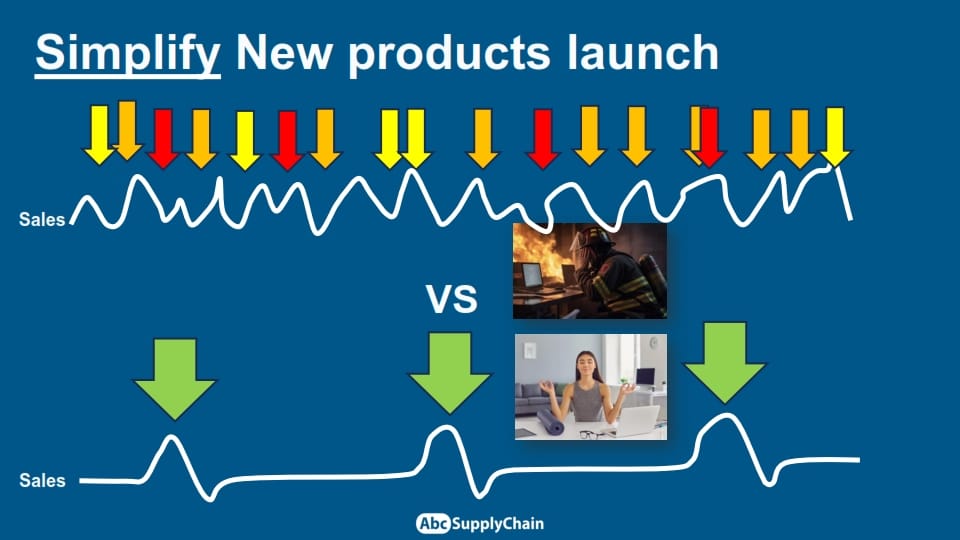

Simplify

While adding new products is always straightforward, each launch adds layers of complexity to management. The focus should be on reducing the frequency of launches while improving their quality by:

- Better execution

- Clearer communication

- Total team alignment

Focusing on fewer, well-mastered launches optimizes efficiency and creates quieter periods for preparing the next new releases. Simplify, refocus, and do better.

Apple’s example :

A good example of this approach is Apple with its iPhone launches. For over 10 years, Apple has followed a simple and effective pattern: an annual launch at the same time, around September 10-12, with few but well-executed products. This regularity makes forecasting easier, thanks to a predictable cycle.

This model shows the importance of simplicity and consistency in managing new products. Less complexity means better anticipation, better execution, and less operational stress.

Frequently Asked Questions (FAQ)

Can you forecast sales for a new product?

Yes, it is possible to estimate demand for a new product by analyzing similar products, gathering market data, and applying the right forecasting methods.

What are the key steps to forecast a new product?

Plan ahead

Standardize the data

Define responsibilities

Compare with similar products

Gather internal and external data

Adjust for seasonality and supply constraints

How to forecast an innovative product with no sales history?

By measuring interest through pre-orders, waitlists, or in-store testing, and gradually adjusting inventory based on early sales data.

What’s the most common mistake in a product launch?

Failing to adjust the forecast after launch. It’s crucial to track real-time sales and revise quantities to avoid overstock or stockouts.

How to avoid forecasting errors during a product launch?

You need to anticipate the novelty effect, monitor the impact of distribution channels, and adjust the forecast based on early market feedback.