When people talk about transforming their supply chain, they often think of tools first: Power BI, SAP, dashboards, connectors, or AI platforms.

But after reading through over 160 survey responses from professionals in Sales and Operations Planning (S&OP) or Integrated Business Planning (IBP), one truth became crystal clear: tools aren’t the primary issue.

This article explores what your peers are really experiencing — friction, fragmentation, and fatigue — and suggests how to address it.

I. Our Ground-Level Survey of 164 S&OP Professionals

We surveyed 164 professionals working in S&OP and IBP roles in 54 countries, covering all five continents, 23 industries, and 12 different job categories.

From pharmaceuticals to retail, aerospace to FMCG, this global snapshot reflects the fundamental tools, struggles, and needs of people working inside the S&OP process every day.

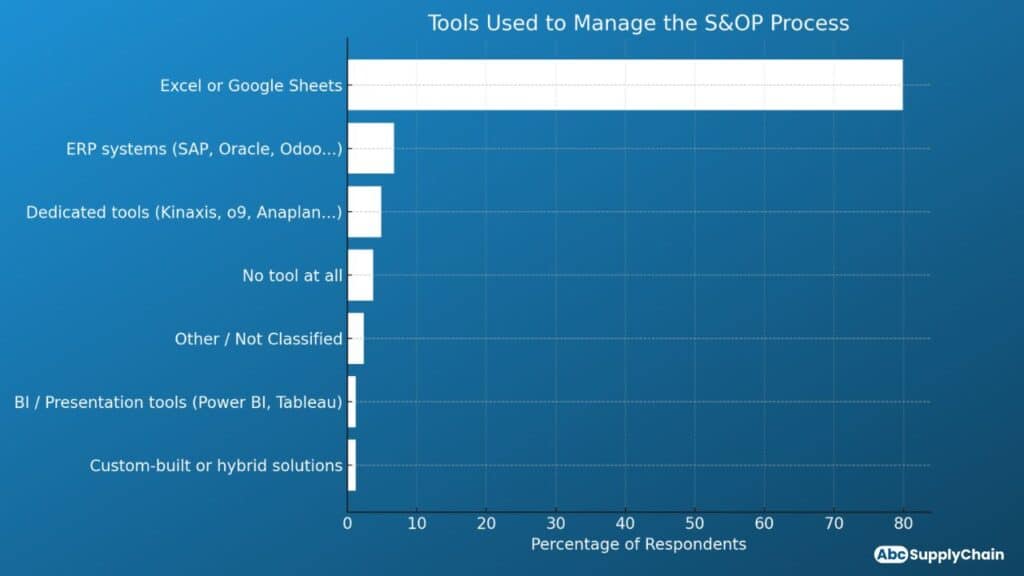

We first asked them a simple question:

“What tools do you currently use to manage your S&OP / IBP process?“

Here’s what people use to manage their S&OP process today:

- Excel or Google Sheets: 81.1%

- ERP systems (SAP, Oracle, Odoo…): 6.6%

- Dedicated tools (Kinaxis, o9, Anaplan…): 5.1%

- Custom-built or hybrid solutions: 3.6%

- BI / Presentation tools (Power BI, Tableau…): 2.1%

- No tool at all: 1.0%

- Other / Not Classified: 0.5%

Some of these people are working in Fortune 500s. With top-tier ERP systems. And yet the vast majority use Excel:

“Even with SAP, we always end up back in Excel. It’s the only thing that really works.” S&OP Lead, Pharmaceutical Sector

The real insight here isn’t that Excel is good. It’s that most companies have not built a real process.

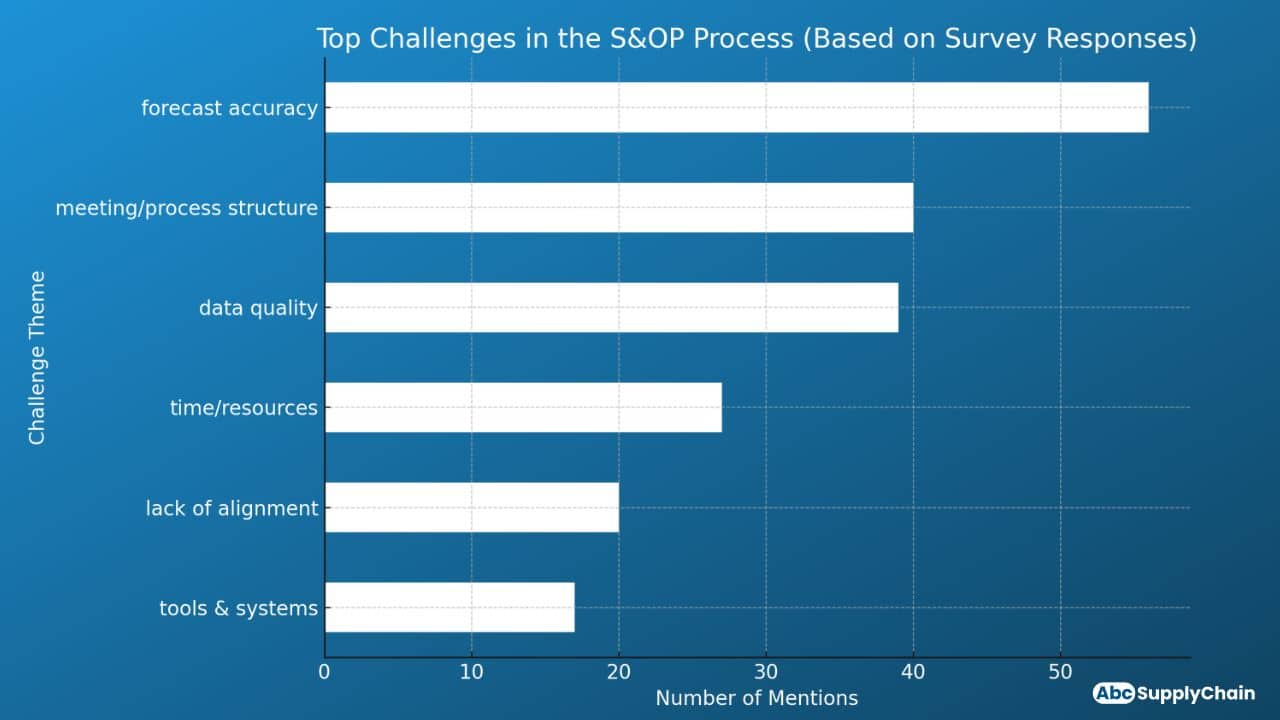

II. The Top 6 Challenges in Today’s S&OP Processes

We asked:

“What are the biggest challenges you face in your S&OP process?”

Over 100 open-ended responses revealed six clear themes:

1. Unreliable Forecasts

“There is a gap between statistical forecast and expectations from management or sales. No one really owns the number.”

— Demand Fulfillment Planner, FMCG

“Uneven supply patterns, fixed capacity, very difficult to predict demand.”

— Management Accountant, Manufacturing

Forecasting is often done without input from key stakeholders, using incomplete or outdated data.

2. No Clear Meeting Structure

“Understanding of S&OP as a process to improve is not the same for all participants. No proper agenda or decision-making path.”

— Country Manager, Manufacturing

“It’s hard to keep everyone focused. The meetings go in every direction and we don’t know what we’re trying to decide.”

— Planning Manager, Industrial Equipment

Many teams run S&OP cycles without a clear structure. Agendas are unclear, roles aren’t defined, and meetings don’t lead to concrete decisions.

3. Poor Data Quality & Fragmentation

“Compilation of data. Complete buy-in and preparation required to ensure the right level of information — and that’s never the case.”

— Sr. Director Forecasting & Replenishment, Manufacturing

“Each team has their own spreadsheet. We waste time reconciling instead of deciding.”

— Supply Chain Analyst, Retail

Teams don’t trust the data they’re given. Inputs are inconsistent, which delays decisions and lowers confidence.

4. Lack of Time or Resources

“Key functions in the business not paying heed to the S&OP process — too busy with day-to-day.”

— Business Unit Lead, FMCG

“My biggest challenge is to implement S&OP process with very limited resources.”

— S&OP Manager, Energy Sector

In many cases, the process isn’t staffed properly or lacks clear leadership. S&OP becomes a side task rather than a core part of business planning.

5. Lack of Alignment Across Teams

“Cooperation with sales is difficult. They don’t provide input on time, and when they do, it’s not consistent with operations reality.”

— General Manager, Consulting

“There is a big disconnect between what sales promises and what we can actually deliver.”

— Operations Manager, Medical Devices

S&OP should be a cross-functional commitment. However, in many companies, each team operates in isolation, and the process lacks shared ownership.

6. Tools/Systems That Are Either Overkill or Not Used

“One of the challenges is we need to manage and update too many systems — nothing’s centralized.”

— Senior Manager Planning & Ops, HVAC

“I am starting from scratch. No demand planning tools. Everything is done in Excel and PowerPoint.”

— Global S&OP Lead, Wine Industry

Some companies are stuck between tools that don’t fit their process and basic solutions like Excel that weren’t designed for collaboration. But Excel isn’t the problem. Misalignment between process and tools is.

The core takeaway is clear: no tool will fix the process without alignment, structure, and shared responsibility.

In the next section, we’ll examine what professionals say they need most and what that tells us about how to proceed.

III. What S&OP Professionals Say They Urgently Need

We asked respondents a simple question:

“What is the ONE thing you need most urgently to improve your S&OP process?”

After analyzing over 100 responses, here’s what stood out:

1. A clearly defined process

Many professionals mentioned the need for a structured framework: defined steps, responsibilities, meeting agendas, and decision-making criteria.

“We need a calendar, agenda and a playbook for each cycle. Today it’s different every month.”

— Planning Manager, Aerospace

“A structured process with clear responsibilities. We’re improvising at every step.”

— Head of Operations, Retail

2. More reliable forecasts

Forecast quality remains a key issue. Respondents want realistic forecasting methods that are accepted by both sales and operations.

“We need better Demand Planning and Decision Making.”

— Country Manager, Manufacturing

“We need to implement demand sensing for our clients.”

— General Manager, Consulting

3. Tools that are simple and effective

Some want better tools — but not necessarily more complex ones. The most common request was for a centralized, easy-to-use solution.

“We need a dedicated S&OP tool.”

— Sr. Director Forecasting & Replenishment, Manufacturing

“We need easy-to use tools.”

— Operations Manager, Agri-food

4. Commitment from leadership and teams

Several responses mentioned a lack of involvement from senior management or key departments (especially sales).

“We need involvement of all departments with a common goal.”

— Supply Chain Director, Pharma

“We need management commitment to the S&OP process.”

— Supply Chain Lead, Energy

IV. 3 pillars of a successful and collaborative S&OP

Over the years, as both an S&OP leader and Supply Chain Director, I’ve lived these challenges firsthand, and helped dozens of professionals rebuild their process from the ground up.

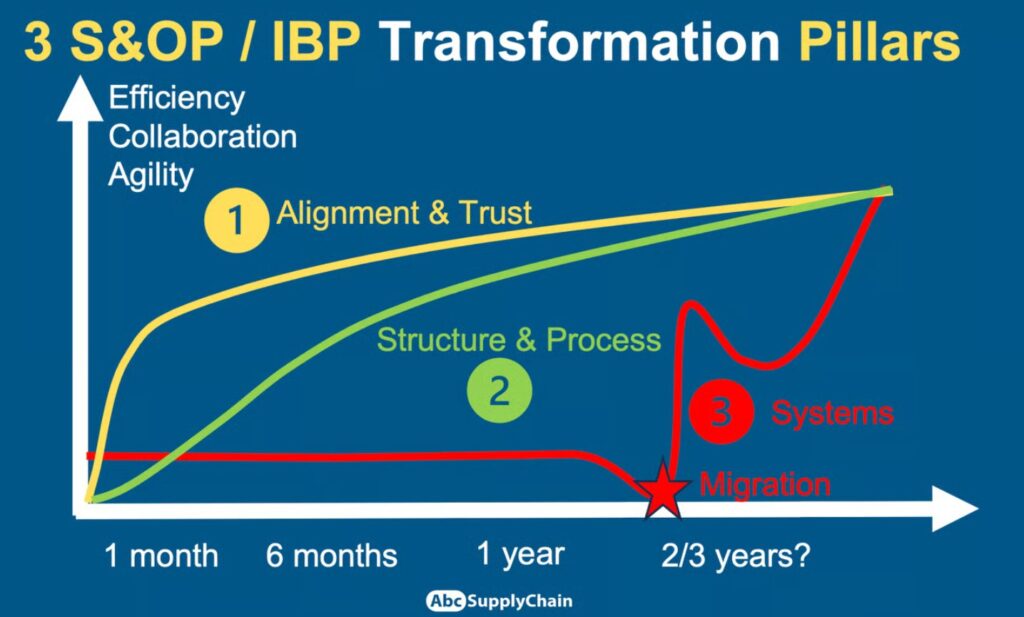

From that experience, I identified 3 pillars in every company that truly succeed with S&OP transformation:

Pillar 1: Alignment & Trust

Foster a culture of safety, ownership, and commitment across teams. This is your foundation.

Pillar 2: Process & Structure

Define clear roles, meeting cadence, inputs/outputs, and common formats.

Pillar 3: Systems & Tools

Automate, visualize, and streamline — but only after building the first two pillars.

When you implement software before fixing collaboration and structure, it rarely works. Many respondents confirmed this.

“We spent a year setting up a new tool. No one uses it because the process wasn’t in place.”

V. A More Practical Approach to S&OP

Instead of starting with software, start with structure. Many companies can improve their S&OP quickly by focusing on:

- A shared calendar and agenda

- A single file or dashboard used by everyone

- Simple forecasting steps

- Cross-functional participation

These changes don’t require a budget. They require ownership.

If you’re looking to build or fix your S&OP process, we’re currently coaching a small group of professionals and companies.

This is a 6-months coaching program focused on:

- Building alignment between teams

- Defining a practical process that works

- Using tools you already have (Excel is fine)

- Reaching results quickly and sustainably

VII. FAQ

Why do so many companies still use Excel for S&OP?

Because it’s flexible and everyone knows how to use it. Excel isn’t the problem — process and alignment are.

Is IBP the same as S&OP?

They’re very similar. IBP typically includes financial and long-term planning, but the operational foundations are the same.

What’s the best S&OP software?

The best tool is the one your team actually uses. No tool can fix a weak process.

What are common mistakes in S&OP implementation?

Starting with software instead of process

Leaving sales or leadership out

Using meetings only to share information instead of making decisions